The accounts payable turnover ratio can be calculated for any time period, though an annual or quarterly calculation is the most meaningful. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. It shows how many times a company pays off its accounts payable during a particular period.

Calculate Average Accounts Payable For the Period

Your AP turnover ratio changes based on the accounting period you’re considering, so the definition of a good ratio changes too. The important thing is to make sure the time period you choose is as “typical” for your company as possible. If your AP balance changes a lot between the beginning and end of the month, don’t just look at the first 5 days or the last 5 days.

Pay your bills early

Businesses can customize tolerance ranges to ensure that unmatched invoices are only paid with the appropriate authorization. This flexibility lets them tailor the matching features to align perfectly with their specific business requirements. The easiest way to keep that straight is to use your accounting forever freedom international software to run your balance sheet for just the starting day and then just the ending day of the accounting period you want to consider. If your ratio is below 5.2, creditors might be more concerned, but it could also mean that you’re deliberately slowing your payments to use your cash somewhere else.

What Is a Good Accounts Payable Turnover Ratio?

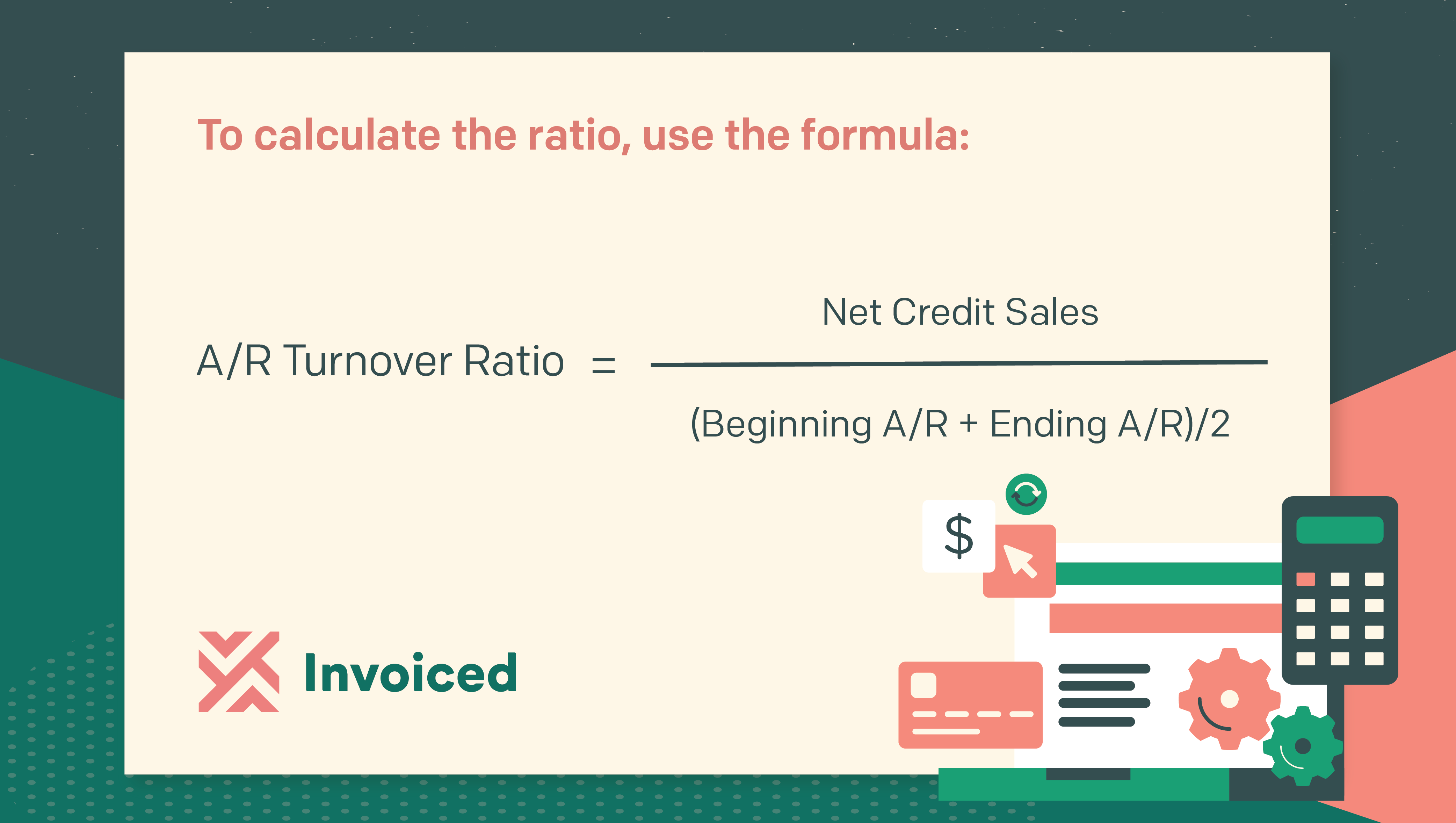

Graphing the AP turnover ratio trend line over time will alert you to a break from your typical business pattern. Corporate finance should perform a broader financial analysis than an accounts payable analysis to investigate outliers from the trend. The AR turnover ratio formula is Net Credit Sales divided by the Average Accounts Receivable balance for the period measured. Similarly calculated, the AP turnover ratio formula is net credit purchases divided by Average Accounts Payable balance for that time period.

Low AP Turnover Ratios

This gives businesses the unparalleled ability to optimize their financial operations. The advanced capabilities help companies to monitor and analyze key financial metrics in real-time. Companies identify trends and spending patterns that help them uncover opportunities for additional cost savings and enhance efficiency.

Accounts payable turnover ratio is important because it measures your liquidity and can show the creditworthiness of the company. This ratio helps creditors analyze the liquidity of a company by gauging how easily a company can pay off its current suppliers and vendors. Companies that can pay off supplies frequently throughout the year indicate to creditor that they will be able to make regular interest and principle payments as well.

Automation tools like Cflow offer scalable solutions to ensure that your financial operations remain efficient, secure, and cost-effective. The ratio is quantified by accounting professionals by calculating, over a specific period of time, the average number of times a company pays its accounts payable balances. How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash? With AP automation, companies gain better visibility and control over their cash flow. Automated systems can provide real-time insights into payable and spending patterns, enabling more strategic decision-making.

- Below we cover how to calculate and use the AP turnover ratio to better your company’s finances.

- Then, divide the total supplier purchases for the period by the average accounts payable for the period.

- A bigger concern, though, would be if your accounts payable turnover ratio continued to decrease with time.

- That, in turn, may motivate them to look more closely at whether Company B has been managing its cash flow as effectively as possible.

- These solutions can automate manual repetitive tasks and streamline the process making it easier to handle the heavy workload.

Therefore, we suggest using all credit purchases in the formula, not just inventory and cost of sales that focus on inventory turnover. A high AP turnover ratio typically reflects positively on a company’s financial health. High ratio suggests that the company manages its payables efficiently, often paying suppliers on time or even early to take advantage of discounts.

Recent Comments